Economic and Business Research Center

The premier source for information on Arizona’s economy since 1949.

The Economic and Business Research Center (EBRC) focuses on applied economic research and community education for Arizona.

Through the Forecasting Project, events such as the Economic Outlook Luncheon, funded research projects and online resources Arizona’s Economy, Arizona-Mexico Economic Indicators and the MAP Dashboard, EBRC makes the latest data and analysis available to Arizona's citizens and decision makers.

DAILY AND WEEKLY ECONOMIC INDICATORS

Going forward we will be tracking key indicators: initial claims for unemployment insurance in Arizona and the U.S., Hotel occupancy rates, movie ticket sales, number of movie releases. Check back often for updates and as we add new indicators.

Just scroll down the page to review and download the indicators. Use your cursor as a tooltip on the charts to view the numbers.

Explore EBRC's Community Sponsored Projects

The Forecasting Project

EBRC’s Forecasting Project team produces the most in-depth economic analyses and forecasts available for Arizona and its communities. These quarterly forecasts aid our community sponsors around the state in their pursuit of the next level of business success. - George Hammond, Forecasting Project director

"Maricopa Association of Governments uses the data, analysis and forecasts from EBRC’s Forecasting Project to add to our understanding of emerging trends in the Phoenix metropolitan area. It gives us another valuable way to view the future of the region."

- Anubhav Bagley, Regional Analytics Director, Maricopa Association of Governments

"EBRC’s Forecasting Project provides the RTA with high-quality data, analysis, and forecasts for the Tucson region that add significantly to our understanding of local economic trends and implications for the future. The economic data we receive is critical to our organization."

- Robert Samuelsen, Chief Financial Officer, Regional Transportation Authority

For more than half a century, the EBRC’s award-winning online magazine, Arizona’s Economy, has brought you the latest economic outlook and forecast data for Arizona, Phoenix and Tucson, plus news and applied research on topics which affect doing business in Arizona. You will also find the latest indicator data for all Arizona’s metro areas and counties.

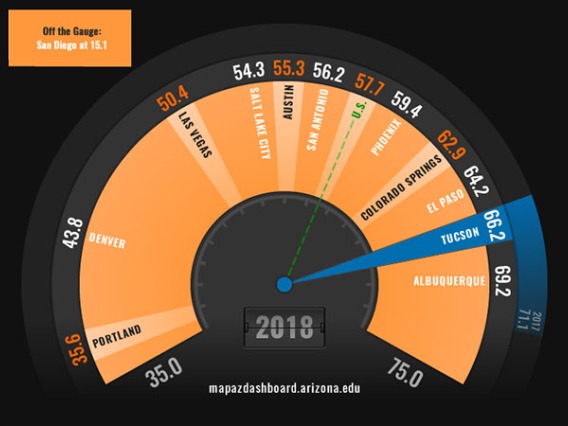

The award-winning Making Action Possible (MAP) Dashboard’s mission is to measurably improve Southern Arizona through data-driven, collective civic action and education. The MAP provides data and analysis on a wide range of socio-economic indicators, while exploring key trends, and allowing for comparison at the metropolitan, state, national, and county level.

Track Arizona’s trade and competitiveness in the U.S.-Mexico region. Find analysis of current issues and data on Arizona-Mexico import/export, commodity flows through Arizona’s border ports of entry, investment, border crossings, population and tourism. We also provide comparative data for other border states and major ports connecting the U.S. and Mexico.

EBRC’s work on the MAP Dashboard website has helped to move the needle in several key areas. It has become the trusted source of information that Southern Arizona uses to benchmark progress and inspire action.

- Ron Shoopman, Chair, Arizona Board of Regents

4.2%

Arizona Payroll Job Growth in 2022

vs. 4.3% for the U.S.

$30.23

Arizona Average Hourly Earnings 2022

Up 6.4% in 2022 vs. $32.25 for the U.S., up 5.4%

7,409,189

Arizona's Population as of July 1, 2022

1.7% annual growth vs. 0.4% for the U.S.

Connect with the EBRC

Contact Us

By Email

General Inquiries

ebrpublications@eller.arizona.edu

By Mail

McClelland Hall 103

The University of Arizona

P.O. Box 210108

Tucson, AZ 85721-0108

Directory

The Economic and Business Research Center website is sponsored by: